Save Money By Adopting These Thrifty Habits

Adopting thrifty habits can help you save money and build financial stability over time. Consider incorporating below mentioned habits in your daily life that could save you lots of money. Even if you are familiar with many of these tips, revisiting your habits again might help you to keep focused.

- Budgeting: Budgeting is a key factor when it comes to saving money. Create a monthly budget to track your income and expenses. This will help you identify areas where you can cut costs and save more.

- Meal planning: Plan your meals in advance, create a shopping list, and stick to it. This reduces impulse buying and minimizes food waste.

- Cooking at home: Eating out can be costly. Cooking meals at home is not only more budget friendly but also allows you to control the ingredients and portion sizes.

- Carry your lunch: Bring your lunch to work instead of buying it. Packing your own lunch can save a significant amount of money over time.

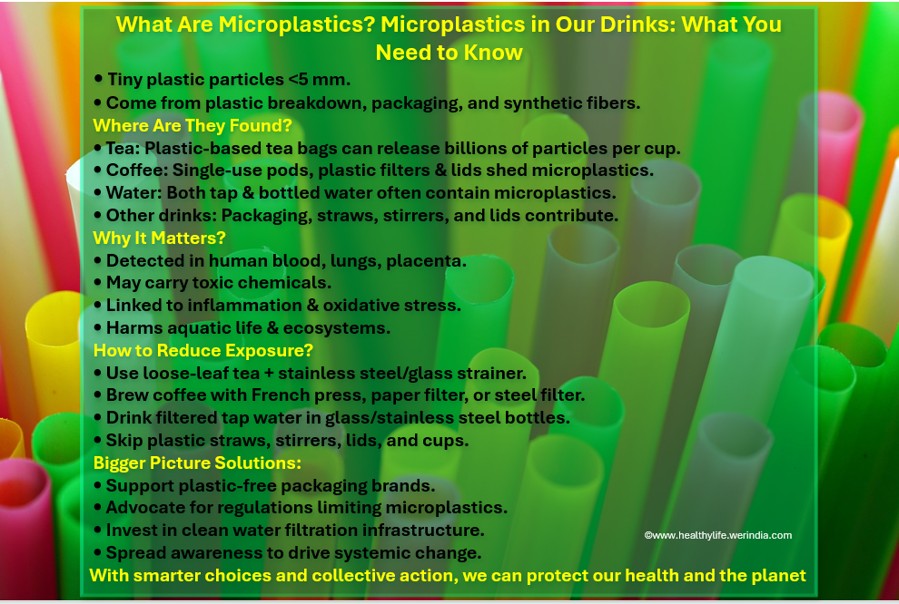

- Limit takeouts and coffee purchases: Cut down on takeout and coffee shop visits. Brewing coffee at home and preparing your meals can save you money in the long run and is good for health too.

- Buy generic brands: Consider buying generic or store brand products instead of name brands. Generic brands often cost less and can be of comparable quality.

- Medicines: Ask your doctor and pharmacist or insurance provider about generic medicine that could be an alternative to the medicines that your doctor prescribed. If there is an option, it will cost you less.

- Sales and use coupons: Take advantage of sales and use coupons when shopping for groceries and other essentials. Look for discounts on items you regularly purchase.

- Buying in bulk: Purchase non-perishable items in bulk: To save money in the long term buy nonperishable items in bulk quantity. This is particularly cost effective for items like rice, dal, toiletries etc.

- Comparison shopping: Compare prices before making a purchase, especially for big-ticket items. Online tools and apps can help you find the best deals.

- Second hand shopping: Consider buying secondhand items for clothing, furniture, and household goods. Thrift stores, consignment shops, and online platforms can offer affordable options.

- DIY repairs and maintenance: Learn basic DIY skills for home repairs and maintenance. Performing simple tasks yourself can save on professional service costs.

- Energy conservation: Save on utility bills by practicing energy conservation. Turn off lights and appliances when not in use, unplug chargers, and consider energy-efficient upgrades.

- Cancel unnecessary subscriptions: Review your subscriptions like streaming services, magazines, Apps and cancel those you don’t use regularly. This can free up extra money.

- Use public transportation or carpool: If possible, use public transportation or carpool to save on gas and transportation costs.

- Gas, petrol or diesel savings: Look for Apps that helps you find lowest price (and good quality) gas/petrol/diesel savings closer to where you live or your way to work!

- Emergency fund: Build an emergency fund to cover unexpected expenses. Having savings for emergencies helps prevent the need to rely on credit and incur debt.

- Mindful spending: Practice mindful spending by questioning whether a purchase is a want or a need. Avoid impulsive buying and take time to consider your purchases.

- Negotiate utility and other bills: Negotiate bills such as cable, internet, or insurance. Providers may offer discounts or better rates if you inquire about available options.

The key to successful thrifty habits is consistency. Start with a few changes and gradually incorporate more as you become comfortable. Practicing and incorporating these changes will help to save. Small, sustainable adjustments can make a significant impact on your financial well-being.

Image credit: Image by Steve Buissinne from Pixabay ( free for commercial use)

Author: Sumana Rao | Posted on: January 23, 2024

« Tips to Make Apartment Spacious and Livable Ways To Chase Fleas Away »

Write a comment